Disruption of the traditional food market, private investing, alternative food and a series of scandals. What do all these have in common? EatJust, more widely known as JUST, is the common denominator. So, should you want to invest in EatJust stock?

The good news is that Eat Just is No. 21 on CNBC’s Disruptor 50 companies, and it is the second time joining this list — back in 2015, it was in No. 24.

The key feature of all 50 companies in this list is that they have the potential to change our modern world, presenting business ideas in such diverse sectors as education, health and fintech.

The bad news is that in recent history there has been some troubling news. As reported on CNBC, “a series of scandals soon plagued the company and CEO Josh Tetrick, including concerns about the safety of its products and an alleged scheme to buy back jars of its JUST Mayo to inflate sales. (The company worked with the FDA to resolve the concerns, and Tetrick has admitted to the scheme’s existence but said it was for quality control.)”

Now, this is meant to be an introduction for investors to EatJust stock. But being a financial analyst and an equity research analyst, these financial shenanigans such as inflating sales are a red flag to me. Why? Because they distort the true financial position of the company. It’s something any potential investor needs to be aware of.

Now that you are aware of it, let’s move on to talk more about about EatJust, its business and its products.

EatJust Makes Plant-based Food Products With an Ambitious Vision

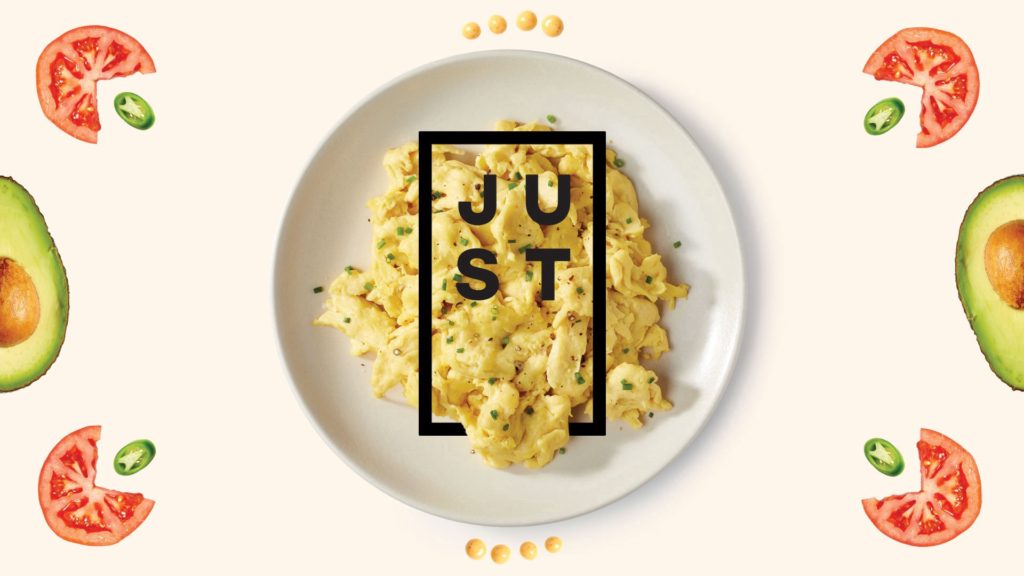

EatJust — formerly known as Hampton Creek — is a company that manufactures and markets plant-based food products. Its flagship product and the one that is now responsible for the core of revenue are plant-based scrambled eggs.